Amid macroeconomic difficulties, longterm forces are continuing to create potential opportunities within real estate.

Real estate investment outlook 2023

Real estate investment trends 2023

Almost no asset class escaped the turmoil of 2022. That includes real estate, where pressures included increased financing costs, rising capitalization rates and inflation. Looking ahead, there is potential opportunity to exploit market inefficiencies, invest in assets at potentially cheaper levels and reposition properties to meet shifting consumer demand. Also, long-term trends such as digitization, more flexible working and delayed household formation are continuing to transform real estate.

Inflation poses a particular challenge. The cost of renovating and developing has risen sharply since the start of the pandemic. And the consequent rise in interest rates has made it more expensive to finance real estate projects. All this can potentially reduce returns for investors. That said, continued rent growth in certain sub-sectors like multifamily apartments and e-commerce–related industrial properties are mitigating headwinds.

We thus look to sub-sectors of real estate that we think may be best placed to perform under these conditions.

Resilient multifamily homes

Getting on the housing ladder is challenging right now. The US mortgage rate sat near a 20-year high of 7.14% as of 9 November 2022. To buy a property, the minimum annual income needed was over $120,000 as of June 2022.

That is more than double the level six years earlier. Compared to previous generations, millennials – those born from the early 1980s to around 2000 – are likely to end up renting for longer before buying their first homes.1

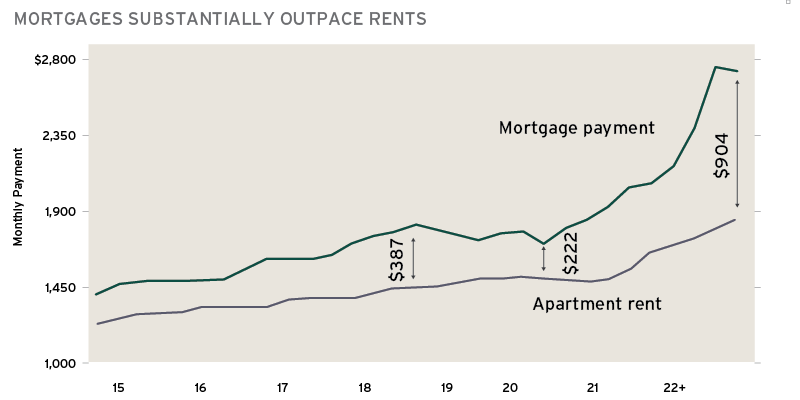

That said, renting is not especially easy now either. Rents too have risen sharply since 2021. However, they are still broadly cheaper than getting a new mortgage. On average, a typical monthly mortgage payment was $904 more expensive than a typical monthly apartment rental payment as of Q3 2022. Four years ago, a mortgage cost only $387 more than renting – Figure 1.2

Chart shows average mortgage payments and rental payments on an apartment from 2015 through September 2022.3

Multifamily rental properties – such as low-rise “garden style”, mid-to-high-rise apartment towers and townhouse complexes – have proven resilient during periods of high inflation. That is because their rents may reset every time their short-duration leases – typically one year – expire. In 2022, multifamily rents have risen significantly alongside inflation. The average effective rental rate for multifamily rental properties in the US had risen almost 17% year on year as of the second quarter of 2022.4

Supply considerations also favor both developers and landlords. According to the National Apartment Association, the US will need 4.3 million new apartment units in the next twelve years to meet increasing housing demand.5 The insufficient supply of housing, coupled with less attainable home ownership and inflation limiting new build, is expected to continue to sustain robust rental demand.

Identifying markets with favorable supply and demand fundamentals and strong demographic tailwinds will be critical, as increased financing costs may impact the profitability for both new developments and existing assets with nearterm debt maturities.

Each 1% increase in e-commerce sales as a proportion of overall retail sales is expected to result in over 65 million square feet of demand for industrial space.

Enabling the e-commerce revolution

E-commerce took a great leap forward during the pandemic. With restrictions on in-person shopping, consumers pivoted to ordering more goods online. These habits have stuck: US e-commerce sales grew 32% year-on-year in 2020, 14% in 2021 and 9% between the first and second quarters of 2022.6 And they are forecast to grow at 10% to 15% annually after the pandemic, gaining more market share from brick-and-mortar stores.7 The same story applies globally, as e-commerce sales have increased 133% over the past five years, and 46% in the first two pandemic years of 2020 and ‘21.8

While e-commerce may reduce the need for retail floor space, online transactions require three times the warehouse space of traditional retail.9 Each 1% increase in e-commerce sales as a proportion of overall retail sales is expected to result in over 65 million square feet of demand for industrial space. E-commerce demand has particularly increased the need for larger, more sophisticated and centrally located distribution centers to enhance “last-mile” facilities for same-day or next-day delivery. This will continue to be the case in 2023.10

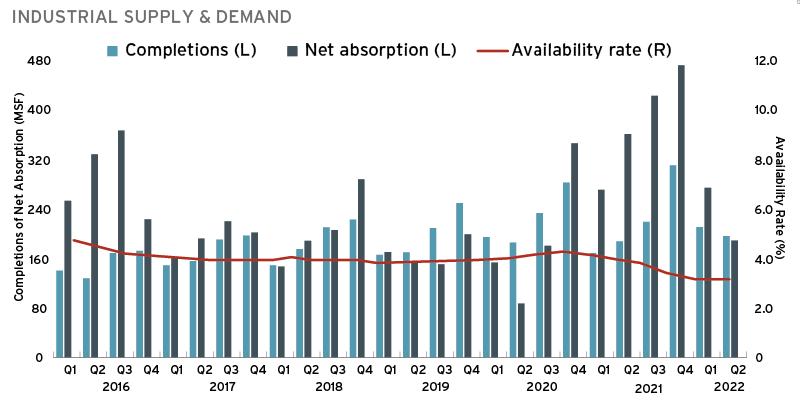

With demand outpacing supply, overall US vacancy rates are historically low at below 4%.11 The US industrial real estate sector – which includes storage and distribution as well as manufacturing, production and research & development facilities – remains strong and stable.

Industrial properties’ overall availability rate dropped by 60bps in 2022 in the US compared to mid-year 2021 due to robust demand and a large amount of preleased construction completions - Figure 2.12 Year-on-year rent growth surpassed 21%..13 As much as 2.1 billion square feet (0.64 billion square meters) of additional e-commerce-dedicated logistics space will be required globally over the next five years to support the growth of internet sales.14

Like multifamily, the industrial sector has held up well amid inflation. Rent growth within logistics has outpaced inflation due to strong tenant demand and to the shorter lease terms – typically 3-5 years – which has allowed rental rates to keep pace as the current market rate adjusts.

Chart shows completions of new industrial properties in millions of square feet, the absorption rate – a metric which looks at how much space was occupied versus how much became available – and the availability rate or how much space was available.

Despite higher interest rates, US commercial capitalization rates continued to edge down across industrial property types in the second quarter of 2022, hovering around 5.1%.15 Capitalization rates are measured as a property’s net operating income, expressed as a percentage of the property’s value. In 2023, industrials’ capitalization rates may rise, but its stability to date speaks for the sector’s resilience.

The industrial market is not immune to increased financing costs nor to slowing growth. But while the outsized e-commerce growth over the last two years may moderate, the long-term outlook for the industrial sector remains positive.

The workplace of the future

Since the pandemic struck, the way we work has changed drastically. Many employers and their employees have enthusiastically embraced flexible, digitization-enhanced working practices, with some firms going wholly remote and many more choosing a hybrid model. The new patterns of work – and changing priorities – are creating strong demand for certain types of offices.

Overall, there is a marked preference for quality. This means offices in highly connected locations, complete with market-leading amenities, including outdoor space and fitness centers, and good sustainability credentials such as LEED platinum, a green certification standard. Meanwhile, older, outdated premises that do not accommodate new ways of working are struggling.

For example, since the start of the pandemic, 84% of total leasing activity in midtown Manhattan has occurred in Class-A assets.16 Over the last two years, new Class-A offices in the US are the only office vintage with positive absorption, a metric which looks at how much space was occupied and how much was vacated. Whereas such offices saw 61.6 million square feet (18.8 million m2) net absorption, those built in 2014 or before suffered negative absorption.17

This appetite for quality is evident in office markets around the world, including Sydney, London, Seoul, Dubai, Shanghai and Berlin. In the US, the leasing of new-vintage offices is unfolding alongside ongoing migration to secondary markets. Companies and workers are increasingly attracted to places such as Austin, Texas, Raleigh, North Carolina and Phoenix, Arizona. Such places offer favorable employment prospects, a potentially better quality of life and lower costs of living.

What to do now?

We believe suitable investors should consider adding appropriate exposure to select multifamily, industrial and office real estate to their portfolios. To do so, we favor strategies from specialist managers with deep expertise in these segments in particular geographies. Such strategies may help mitigate the effects of inflation upon returns while helping to mitigate the risks of a globally diversified allocation.

Of course, private investments in real estate come with various risks. These include illiquidity, with investors typically having to make a commitment for some years. A deeper economic contraction than we expect might also moderate rent growth and demand in the near term.

Wealth Outlook

Explore other articles from Wealth Outlook 2023:

To help put you in touch with the right Private Bank team, please answer the following questions.