Seeking value within US markets

Within US markets, we believe there are areas of relative value worth investing in as we enter and recover from a rolling recession. An important area of note are SMID stocks, which currently trade at a 30% valuation discount to US large caps for profitable firms.5 SMID stocks generally perform best in the first year of a recovery when their earnings are expected to rebound.

The S&P MidCap 4006 and the S&P SmallCap 6007 are two additional categories that may provide profit opportunity. Focusing on profitable small- and medium-sized companies is advisable when the Fed reduces rates to fight unemployment, as we believe it will soon.

Broadening our tech and growth equity exposures

Early in the pandemic, from 2020-2021, the valuations of large tech stocks surged. Then, in 2022, we saw a reversal. Valuations of growth shares dropped as the Fed increased the Fed Funds rate at an unprecedented pace.

But as the yield curve inverted, investors have started to refocus their attention to technology companies with strong balance sheets and growth prospects. Even though US industries have powerful and promising growth prospects, 2023’s tech gains have been limited to a handful of companies. Large Cap US IT is up 37% year to-date.8 Firms providing the infrastructure for a new form of artificial intelligence, known as generative AI (See Generative AI: The beginning of (another) technological revolution) are responsible for a lot of that gain. And while we will add further exposure to generative AI, many other future portfolio opportunities may lie in small- and medium-sized tech companies whose valuations do not yet reflect their future growth potential.

Alternative investing and private credit

Finally, we see an opportunity within alternative investments for qualified investors. A shortage of capital now exists in private credit. Banks have pulled back their lending due to deposit woes and an overexposure to commercial real estate assets, like office space. The Fed is continuing quantitative tightening, while the Treasury is ramping up borrowing and investors are hoarding cash and short-term investments. For qualified investors, it may be possible to earn equity-like rates of return in selected debt securities.

Loans for private equity buy-outs, lending to later stage venture companies, mezzanine debt for real estate refinancings and other similar lending opportunities are yielding more than 10% per annum.9 Unlike in 2008-09, we do not see a credit collapse on the horizon. Corporate balance sheets are in good shape with future credit problems likely to be concentrated in commercial real estate. Capital shortages do not occur frequently, so this is an area where qualified private investors may benefit for the next three to five years.

Watch for signals

The double-digit declines in both stocks and bonds in 2022 — the worst combined return for 60/40 portfolios since 193110 — reset valuations and the relative value of different portfolio investments. In anticipation of poor market conditions in 2022, we doubled up on defensive investments in 2021.

Though we prefer the long-term return properties of dividend growth shares, we expect to return to a normal weighting. And while we currently enjoy a high yield on short-term high-grade bonds, we will rotate from them to intermediate US and emerging market credit to continue to seek income and potentially benefit if and when rates fall. We will move from defensive to overweight risk assets as a result of valuation improvements and market dislocations as they arise.

The US Treasury hit its debt ceiling at the start of 2023 and took emergency steps to limit debt issuance. Now, we expect $1.3 trillion in new borrowings, likely by the end of the third quarter of 2023. When the Treasury needs to raise a huge amount of capital and the Fed continues to tighten, we anticipate that fears about more Fed policy tightening will lower prices of already attractive assets.

Looking ahead

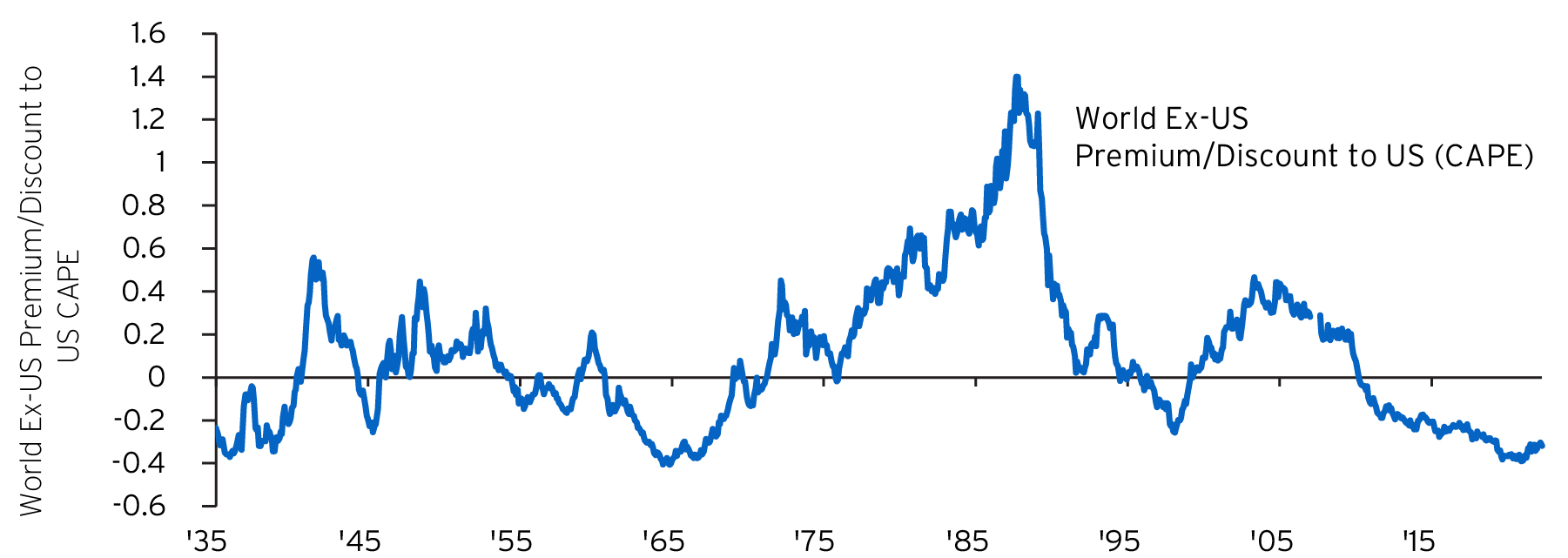

One of the reasons we are seeking to diversify equity exposures from the S&P 500 is that large-cap stocks have performed above expectations over the past two years yet actual S&P 500 earnings per share has declined in 2023. This means we see them as expensive on a relative basis. While they may rise in value in 2024, US large cap shares are less likely to lead the market higher.

To capture the potential of our new Strategic Return Estimates,1 we will consider rotating toward different risk assets, geographies and strategies in the second half of 2023 and into 2024. We may diversify our equity selections and “go overweight” across equity strategies as potential opportunities become apparent.

We expect US bonds to act as a foundation for portfolios, seeking positive real yields and negative correlation to reduce portfolio volatility. Here we will seek diversification to non-US bonds and to longer dated securities, but as we expect rates to decline, we see a reallocation to equities as likely.

The risk of being early versus staying on the sidelines

When T-bill rates and cash balances are high, it is tempting to do nothing. In the near-term, that may seem safe, but looking out one year, we believe that those who do not own core portfolios may be less well-off. After the double market shocks of the pandemic and an overly reactive Fed, the next decade looks like one where returns may be above average. Those who stay in cash will not see returns when markets are recovering.

Market timing hurts portfolio returns. The worst and best days in a market often occur near one another, and you cannot afford to miss the big up days. What investors should focus on is the value of active asset allocation, which is about choosing what to invest in and when.

Over the coming months, we strongly urge investors to reduce their exposure to cash as an asset class. Extending duration should be an investor’s first step. While we may be early when buying certain equities or bonds, our goal is to capture the “total return” of an underperforming asset class. This requires foresight and a willingness to act.