Geopolitical, economic and market developments have reinforced our investment case for cyber security in 2022. We reiterate the potential opportunity for portfolios.

Investing in cyber security 2022

Digital technologies are transforming the world around us. Thanks to their deployment over recent decades, we can now do business, consume and communicate more efficiently than ever before. Nevertheless, we believe that the digital revolution still has far to go.

Over the coming years and beyond, we expect digitalization to disrupt and improve many other aspects of our lives. Autonomous vehicles, fully smart homes and widespread remote surgery are just some of the advances we envisage. Enabled by ever-faster connectivity, these developments will see a massive increase in the amount of data that needs to be stored and analyzed in cloud facilities.

As we become ever more reliant on digital networks and data, the more important protecting them becomes. Attempts by cybercriminals to thieve, extort ransom and inflict malicious damage are likely to intensify. Sophisticated cyber defenses are thus integral to protecting our data, wealth, economic activity and national security. We believe the need for continuous spending here makes cyber security an unstoppable trend.

The importance of cyber security in 2022

Times of conflict have frequently seen new technologies develop rapidly, as combatants strive to gain the upper hand. The emergence of armored tanks in World War One, jet engines and radar in World War Two, and unmanned drones during post-9/11 counterinsurgency operations are prominent examples. The Russia-Ukraine war could spur cyber security innovations.

The conflict has already seen cyber warfare waged alongside the armed struggle, with both state and non-state actors targeting websites and networks. A report by Microsoft’s Digital Security Unit1 highlighted 40 destructive attacks between 23 February to 8 April 2022. Over 40% of these targeted organizations in critical infrastructure sectors – including nuclear, other energy and communications – with almost one-third aimed at Ukrainian government organizations.

We believe that the longer the war continues, the likelier that escalation of such cyberattacks becomes. Not only might such activity be directed at Ukrainian targets, but also toward countries that are standing with Ukraine. Retaliatory moves could then follow. Rather than more of the same, such cyberattacks could prove ever more creative, as might the defenses against them.

Increased investment will be an important driver of cyber innovation. Just as we expect greater military spending in the years ahead, we believe it vital that governments and private organizations invest more in state-of-the-art cyber defenses during wartime and peacetime.

Defensive qualities of cyber security stocks

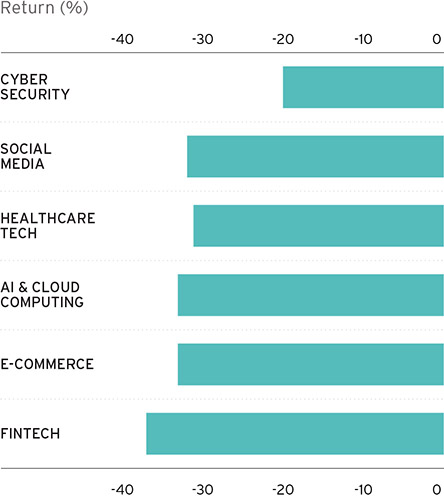

Amid a bear market in the tech-heavy Nasdaq 100 Index, cyber security has fallen 19% year-to-date. It has outperformed most other secular growth themes in a challenging environment for all such equities.

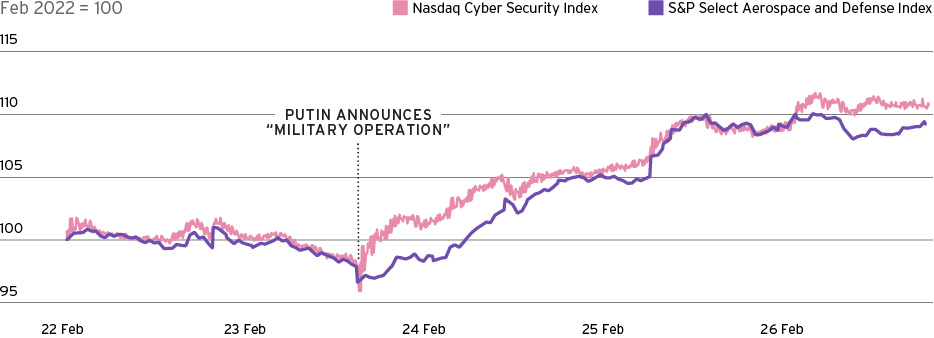

The outbreak of war in Ukraine in late February catalyzed a partial recovery in the cyber sub-sector, as investors recognized its services’ importance amid the conflict. However, a challenging first quarterly earnings season in early May led to a broad sell-off across the enterprise software landscape, with cyber firms falling in concert. Going forward, however, we continue to view spending on cyber security as a more durable segment of corporate tech budgets. We also expect a peak in long-term interest rates this year to help drive recovery in high-quality growth equities broadly, including cyber security.

How to invest in cyber security?

Geopolitical, economic and market events in 2022 have reinforced our case for including cyber security in portfolios.

The global economic slowdown is set to make earnings growth harder to achieve for many companies. However, since we see cybersecurity spending as a non-discretionary item, we believe the sector can better withstand economic pressures. The sector’s earnings profile has proved more defensive than technology companies more broadly in recent years. Cybersecurity equities’ relatively robust performance this year also speaks to their quality growth and defensive characteristics.

Among cyber security equities, we prefer specialists in cloud, identity and data security. These offer potentially strong growth as ever more sensitive data shifts to centralized third-party servers. Meanwhile, leading firewall vendors who historically specialized in on-site server protection face disruption if they cannot reinvent themselves for today’s cloud-based ecosystem.

The state of the world today calls for increased cyber defenses. Likewise, we believe that cyber equities could help bolster portfolio defenses.

Mid-Year Wealth Outlook 2023

While our asset allocation strategy remains defensive, investors should consider staying invested and modify portfolios over time.

To help put you in touch with the right Private Bank team, please answer the following questions.