SUMMARY

We believe that we are in, and will continue to see, a “bond picker’s market,” and that various hedge fund strategies may be key to finding potential opportunities therein.

We believe that we are in, and will continue to see, a “bond picker’s market,” and that various hedge fund strategies may be key to finding potential opportunities therein.

Proponents of active management have frequently touted the idea of a “stock picker’s market” – that over the long term, fundamentals will dictate performance of individual equities, and that after periods of high correlation, managers with expertise in security selection will take advantage of differentiation between winners and losers – but we rarely hear the same in fixed income.

But why? Should it be the case that stocks present better opportunities for active management versus bonds?

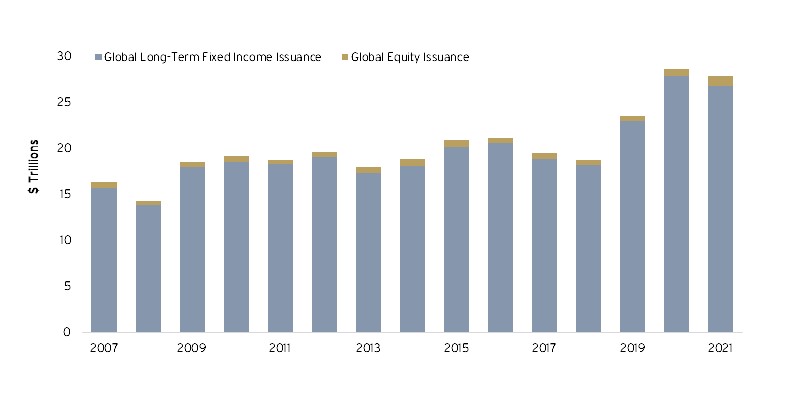

One might assume that this is because the stock market is larger and more active than the fixed income markets that they simply afford more opportunity. This, however, is simply not the case – the global fixed income markets are nearly identical in size to the global equity markets with both over $100 trillion in size, but fixed income typically has annual issuance of 20x that of equity securities.1

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|---|---|

|

CLO Debt |

CLO Debt |

Non-Agency RMBS |

Non-Agency RMBS |

High Yield |

Non-Agency RMBS |

US CMBS |

High Yield |

High Yield |

US CMBS |

Bank Loans |

|

Non-Agency RMBS |

Non-Agency RMBS |

US CMBS |

EM Debt |

CLO Debt |

CLO Debt |

Non-Agency RMBS |

EM Debt |

EM Debt |

Non-Agency RMBS |

CLO Debt |

|

US CMBS |

High Yield |

EM Debt |

US CMBS |

Bank Loans |

EM Debt |

Bank Loans |

US CMBS |

CLO Debt |

High Yield |

Non-Agency RMBS |

|

EM Debt |

Bank Loans |

CLO Debt |

CLO Debt |

EM Debt |

US CMBS |

CLO Debt |

CLO Debt |

Non-Agency RMBS |

Bank Loans |

High Yield |

|

High Yield |

US CMBS |

High Yield |

Bank Loans |

Non-Agency RMBS |

High Yield |

High Yield |

Bank Loans |

Bank Loans |

CLO Debt |

US CMBS |

|

Bank Loans |

EM Debt |

Bank Loans |

High Yield |

US CMBS |

Bank Loans |

EM Debt |

Non-Agency RMBS |

US CMBS |

EM Debt |

EM Debt |

The Alternative Investments team combines global expertise and local insight to deliver compelling opportunities in private equity, real estate and hedge funds.

To help put you in touch with the right Private Bank team, please answer the following questions.