SUMMARY

Demand for fine homes in the English countryside has held up well despite the resurrection of urban life after lockdowns. Supply constraints and changing buyer tastes could help sustain activity.

Demand for fine homes in the English countryside has held up well despite the resurrection of urban life after lockdowns. Supply constraints and changing buyer tastes could help sustain activity.

England’s countryside can be a comfortingly predictable place. Compared with the nation’s capital, it enjoys a longstanding reputation for unspoiled landscapes, cleaner air and a gentler rhythm of daily life. Many of its villages and farmsteads would today be largely recognizable to their inhabitants of many generations earlier, quite unlike London’s glimmering skyline of steel and glass megaliths.

The countryside’s relative tranquility has also been a hallmark of its real estate market. Especially in recent years, prices for fine country homes have resembled the sort of placid, uneventful scene that the great English romanticist painter John Constable loved to depict.

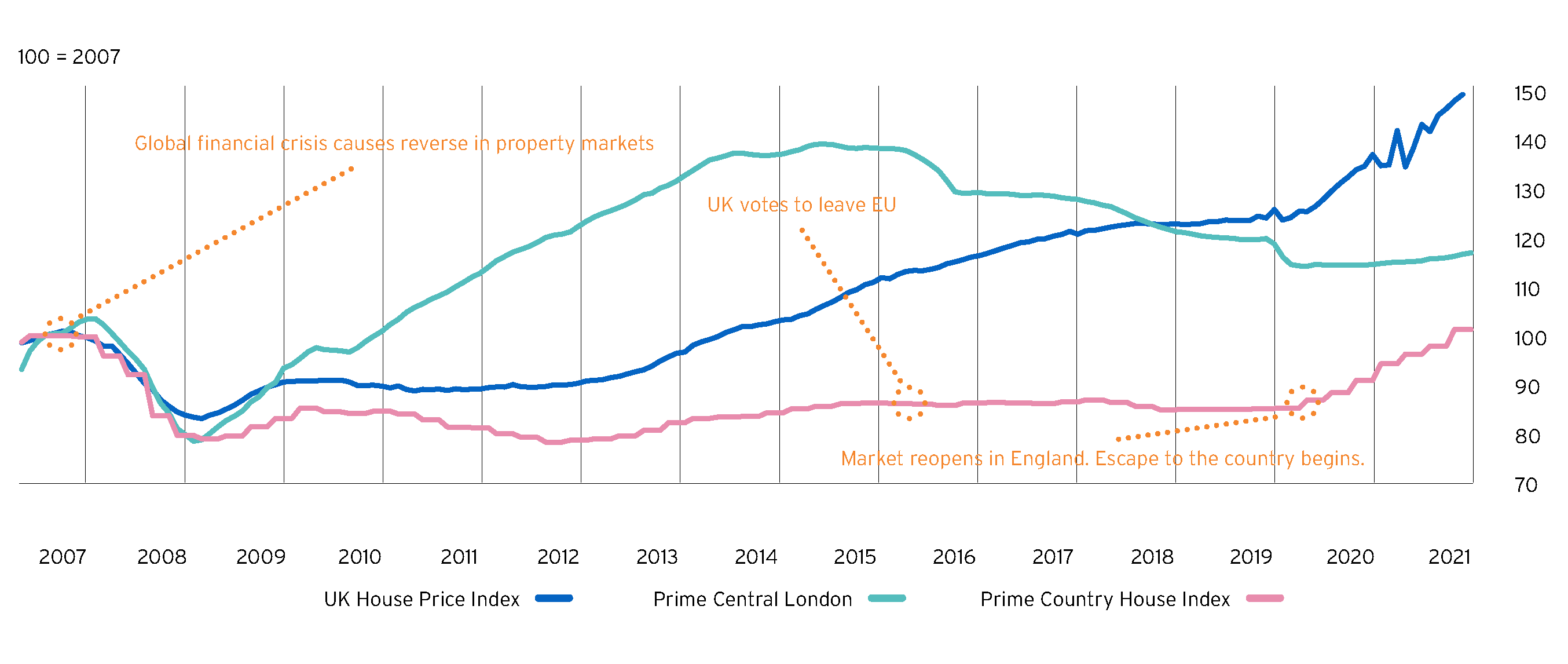

In the decade after 2009, the Knight Frank Prime Country House Index – which tracks the performance of high value properties such as manor houses, farmhouses and cottages – saw a mere two quarters where annualized growth exceeded 5% - figure 1. It also suffered two spells of falling prices. But then the COVID-19 pandemic struck.

The upsurge in demand for prime countryside homes was immediate. Rather than enduring confinement in an apartment or townhouse, many of those with a London presence sought out the space, scenery and seclusion of England’s shires. Some affluent families paid a year’s rent upfront to secure the rural retreat of their dreams, while buying enquiries surged as the nation’s first lockdown eased in May 2020.

Leading the charge higher since then have been more expensive properties. In seven out of eight quarterly periods since the market reopened in May 2020, country homes worth £5m ($6.29m) and upward have registered the strongest gains in the prime category – figure 2. Indeed, 2021 saw the most sales of such residences in 15 years, beating the record set the previous year by 21%. As of March 2022, the £5m+ ($6.29m+) value band was 18.5% higher than it was 12 months previously.

This performance has surprised even the market’s most experienced observers. “It’s fair to say that it’s all lasted longer than we might have predicted,” says Chris Druce, Senior Research Analyst on the residential team at Knight Frank, a leading independent global real estate consultancy.

Traditionally, after a surge in the market such as we’ve had with country homes, what you’d see next is everything going quiet. But although we’ve had a few dips, this trend isn’t going away,

he says.

The positive momentum has persisted despite two important shifts since mid-2020. The first is the near-total resumption of pre-COVID normality, with England having cast away almost all pandemic restrictions. London and its other cities are back in full swing, with restaurants, theaters and galleries thronging with mask-less crowds, eagerly making up for two largely lost years.

The tax on buying prime countryside properties has also gone up over time, especially for overseas buyers who don’t live in the UK full-time. Stamp duty, which is paid in England and Northern Ireland, applies a slice approach, with different levels of tax paid on different portions of the purchase price. (Scotland and Wales have their own systems).

To support the housing market in 2020, the UK government waived stamp duty – or purchase tax – on the first £500,000 ($628,897) of each home bought until June 2021, with a 3-month taper period after this. It has also imposed a surcharge of 2% on the stamp duty for non-residents, taking the top rate of stamp duty for such individuals buying a high-end home to 17% for the portion of the purchase price over £1.5m ($1,886,692)

While England is striving to put the pandemic behind it, the COVID experience seems to have wrought lasting changes in priorities and habits. Most of all, working from home – albeit if only part of the time – looks set to endure. Unlike London’s eateries and concert halls, its offices remain semi-occupied, with many choosing to attend two or three days a week at most.

The time and energy savings from avoiding a daily commute – even if only a chauffeuring from Chelsea to Canary Wharf – are now almost universally appreciated. And the freedom to spend more time with loved ones in second homes outside the capital clearly increases their utility – and hence their prices.

Given that countryside homes increasingly serve as part-time workplaces, the requirements of owners and buyers are evolving. A robust broadband connection, for example, is no longer just a nice-to-have. And some purchasers are creating small office units in the grounds of their new homes such that they and perhaps key aides can do a full day’s work before strolling back across the lawn to the main house.

Just as lifestyle considerations are currently particularly favorable for the English prime countryside market, so are certain technical features. Despite their strong run, prices as measured by Knight Frank only surpassed their previous peak level in 2007 in March. This is a far slower recovery than mainstream and prime London prices have experienced in this time, which likely leaves further room for upside.

What is more, supply remains tight. “New instructions from sellers were down 8% in the first quarter of 2022,” says Chris Druce. “At the same time, new prospective buyers were up 42%. Clearly, this is a very good time to be a seller.”

Nevertheless, a few clouds have recently emerged in what were previously all-blue skies. Russia’s invasion of Ukraine has raised geopolitical uncertainty and dampened economic growth expectations. Even prior to the conflict, the Bank of England had begun raising interest rates. Inflationary pressures may mean that it continues to do so in 2022. Against this backdrop, prime country price growth is expected to slow to 5.5% by the year’s end. However, the spring market remains a seller’s environment, with high demand and tight supply.

It’s clearly become harder to predict what will happen, but we’re still looking at strength,

says Chris Druce.

There are certainly plenty of factors in the mix, but what we’re not seeing is a big dampening down and it remains a very busy spring market.

While the English countryside remains a place of timeless tranquility, the market for its high-end homes may see further frenetic activity.

If you would like to discuss any of the issues raised in this article in more detail, please contact your Private Banker directly.

To help put you in touch with the right Private Bank team, please answer the following questions.