SUMMARY

It’s been another year of progress for the global art industry, with the emergence of NFTs and traditional art prices continuing to rise. A new Citi GPS report explores these developments and considers what might follow.

It’s been another year of progress for the global art industry, with the emergence of NFTs and traditional art prices continuing to rise. A new Citi GPS report explores these developments and considers what might follow.

The COVID-19 pandemic has been a catalyst for rapid change in the global art market.

In response to the worst public health crisis in more than a century, the industry adeptly embraced digitization.

As we discussed in this 2020 Citi Global Perspectives and Solutions (GPS) report, leading auction houses successfully conducted online auctions, while art fairs wowed attendees with exciting new virtual experiences.

This broad-based adaptation was all the more impressive considering that the industry had previously been behind the curve in its deployment of new technology.

As pricing has become more transparent and the user experience more convenient, we have seen an influx of millennials, for whom buying online is second nature.

Over a year later, the art industry continues to transform and adapt.

Thanks to digitization, a wider and more diverse range of people than ever before now has access to the market.

In turn, this has created a stronger focus on diverse artists and genres, and on artists who work outside mainstream platforms. We expect this to continue in 2022 and beyond, along with new synergies between auction houses, galleries, artists, and collectors, as well as sustained growth in private sales.

If 2022 is anything like 2021, we can expect the art market to grow and evolve further and faster.

The biggest change in 2021 was the rise of non-fungible tokens, or NFTs.

While almost non-existent in 2020, the market for NFTs generated sales of almost $25 billion in 2021 and then $7.4 billion in January 2022 alone.1

NFTs are not only a new way to consume art and collectibles, but are disrupting the traditional art ownership model.

This disruption is catalyzing change for both the artists and traditional distributors of art.

It allows the former to monetize their work and talent equitably.

For the latter – including auction houses and galleries – it has meant business growth, thanks to their nimbleness in embracing the phenomenon.

Ultimately, the rise of NFTs has helped drive an increase in overall art sales, with $2.3 billion of art sold in just a two-week span at the November 2021 auctions.2

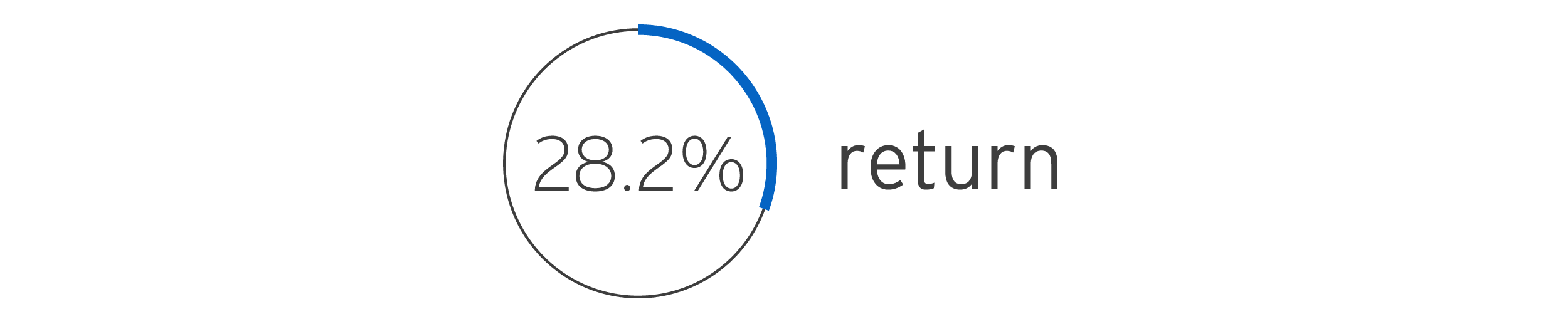

The strength of the art market throughout the COVID-19 pandemic is also reflected in the performance of certain major art indices.

From January 2020 through June 2021, the Masterworks.io All Art Pricing Index delivered a 28.2% .3

That’s comparable to broad, publicly traded risk asset classes including developed market equities, emerging market equities, and commodities.

Broad shifts in real interest rates from negative to deeply negative, helped by stimulus and central bank asset purchases, contributed to performance.4

Regulation has been and will continue to be a feature of the art market for the foreseeable future.

There are still some teething troubles for the NFT market, for example, with issues surrounding trademark infringement, security regulations, and the potential for fraud and abuse.

But it is not just the digital art market raising concerns among regulators.

Lawmakers around the globe have started to implement new laws and regulations requiring certain art market participants to help prevent and detect money laundering in their operations.5

With single NFTs regularly selling above the million-dollar threshold, a question also exists about whether the NFT market can sustain its current levels.6

However, as noted by Anders Petterson, Founder and Managing Director of ArtTactic, Bursting bubbles rarely signal the end, but rather the beginning of a new development phase.